Navigating Property Information in Anderson County, South Carolina: A Comprehensive Guide to the Tax Map

Related Articles: Navigating Property Information in Anderson County, South Carolina: A Comprehensive Guide to the Tax Map

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Property Information in Anderson County, South Carolina: A Comprehensive Guide to the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Property Information in Anderson County, South Carolina: A Comprehensive Guide to the Tax Map

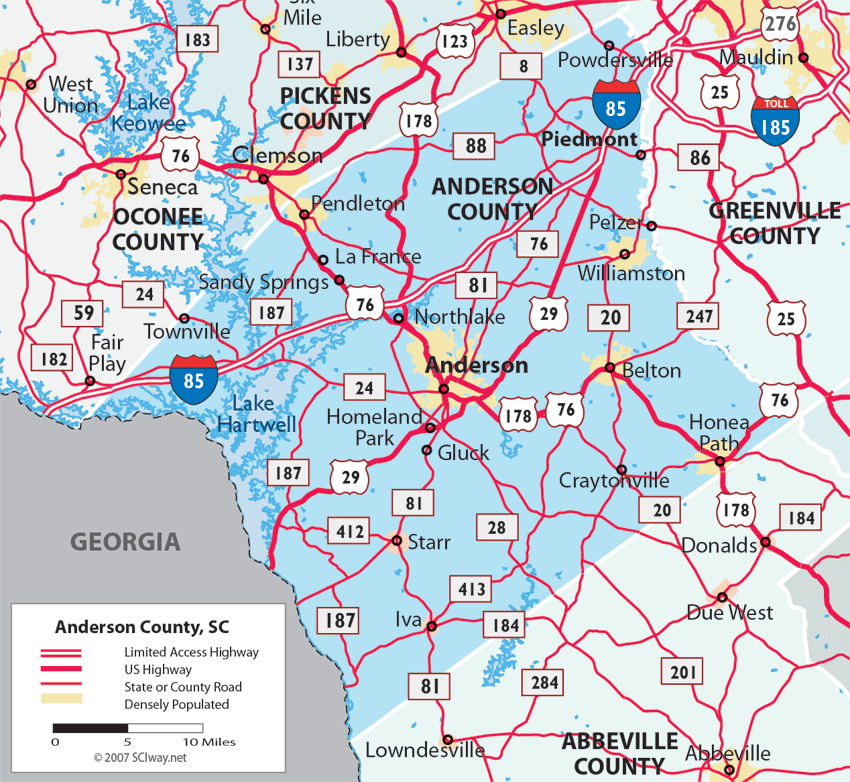

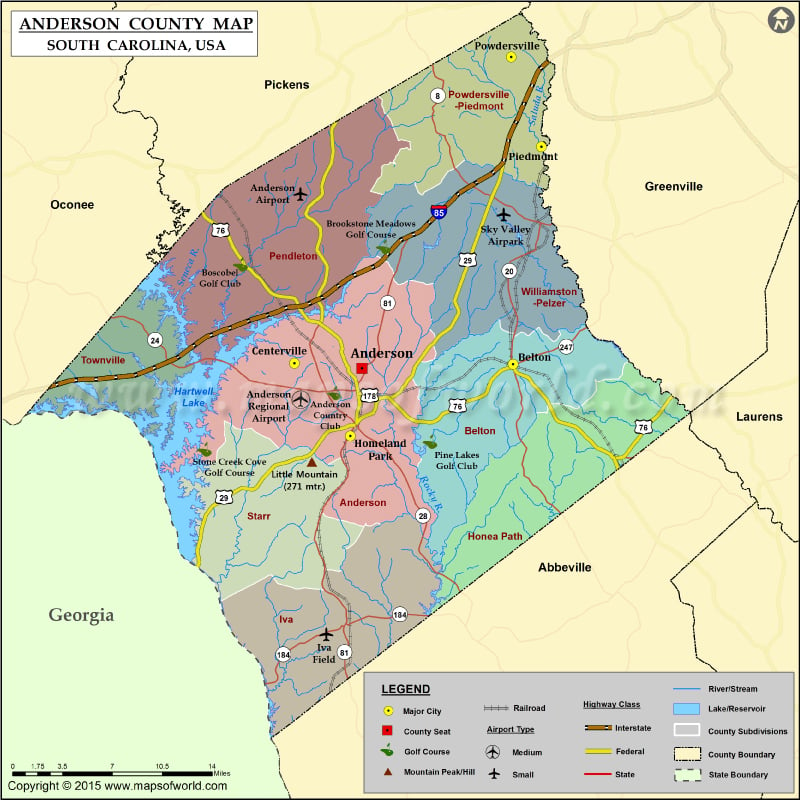

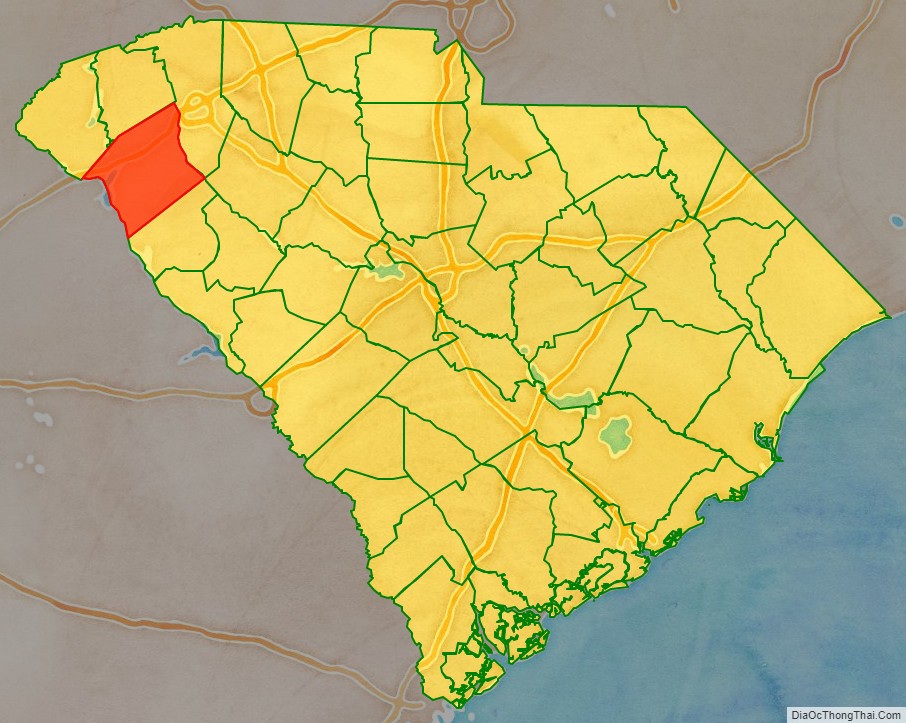

Anderson County, South Carolina, boasts a diverse landscape, encompassing rolling hills, scenic waterways, and bustling urban centers. This vibrant county attracts residents and businesses alike, making it crucial to have access to reliable and detailed information about properties within its borders. The Anderson County Tax Map, a valuable resource maintained by the Anderson County Assessor’s Office, serves as a comprehensive guide to understanding the county’s property landscape.

Understanding the Purpose and Structure of the Anderson County Tax Map

The Anderson County Tax Map is a digital and physical representation of the county’s property parcels. It serves several vital purposes:

- Property Identification: The map assigns a unique identification number to each individual property parcel, facilitating accurate record-keeping and property transactions.

- Property Valuation: The map displays the assessed value of each property, which forms the basis for property tax calculations.

- Location and Boundaries: It clearly defines the boundaries of each property, providing accurate information on size, shape, and location.

- Land Use Classification: The map indicates the designated land use for each property, whether residential, commercial, agricultural, or industrial.

- Public Access and Utilities: It displays information on road access, utility lines, and other public infrastructure associated with each property.

The Anderson County Tax Map is organized into a grid system, with each parcel assigned a specific location within this grid. This grid structure allows for efficient navigation and retrieval of information related to individual properties.

Accessing the Anderson County Tax Map: A User-Friendly Experience

The Anderson County Assessor’s Office provides convenient access to the Tax Map through various channels:

- Online Access: The Assessor’s Office website offers a user-friendly interface for searching and viewing the Tax Map. Users can input property addresses, parcel numbers, or other relevant information to locate the desired property.

- Physical Copies: The Assessor’s Office provides hard copies of the Tax Map upon request, allowing for offline access to property information.

- Public Records: The Tax Map is considered a public record and is available for inspection at the Assessor’s Office during regular business hours.

Leveraging the Anderson County Tax Map: Practical Applications and Benefits

The Anderson County Tax Map serves as a valuable resource for a wide range of individuals and organizations, including:

- Property Owners: Owners can use the map to verify their property boundaries, assess their property value, and understand potential development restrictions.

- Real Estate Agents and Brokers: The map provides essential information for property listings, market analysis, and client consultations.

- Appraisers and Assessors: The map serves as a primary reference tool for conducting property valuations and ensuring fair assessment practices.

- Developers and Investors: The map helps identify potential development sites, assess property suitability, and understand zoning regulations.

- Government Agencies: The map assists in planning and infrastructure development, managing property taxes, and addressing land use concerns.

- Researchers and Historians: The map provides valuable insights into the historical development of Anderson County and its property landscape.

Navigating the Tax Map: Tips for Effective Utilization

To maximize the benefits of the Anderson County Tax Map, consider these helpful tips:

- Utilize the Online Search Functionality: The Assessor’s Office website provides a robust search engine that allows for efficient property retrieval using various criteria.

- Familiarize Yourself with Map Symbols and Legends: Understanding the symbols and legends used on the Tax Map is crucial for accurate interpretation of property information.

- Contact the Assessor’s Office for Assistance: If you encounter any difficulties navigating the map or require clarification on specific details, the Assessor’s Office staff is available to provide guidance.

- Verify Information with Official Records: While the Tax Map is a reliable resource, it is always advisable to verify critical information with official property records.

- Stay Updated on Map Revisions: The Tax Map is regularly updated to reflect changes in property ownership, land use, and other relevant factors.

FAQs: Addressing Common Questions about the Anderson County Tax Map

Q: How do I find a specific property on the Anderson County Tax Map?

A: The Assessor’s Office website provides a user-friendly search interface. You can input the property address, parcel number, or owner’s name to locate the desired property.

Q: What information is included on the Tax Map?

A: The map displays property boundaries, assessed value, land use, public access, and other relevant information.

Q: Can I access the Tax Map online?

A: Yes, the Anderson County Assessor’s Office website provides online access to the Tax Map.

Q: What is the assessed value of my property?

A: The assessed value of your property is displayed on the Tax Map and is used to calculate property taxes.

Q: How often is the Tax Map updated?

A: The map is updated regularly to reflect changes in property ownership, land use, and other relevant factors.

Q: What are the zoning regulations for my property?

A: The Tax Map displays the designated land use for each property, which is subject to zoning regulations.

Q: Can I request a hard copy of the Tax Map?

A: Yes, you can request a hard copy of the Tax Map from the Assessor’s Office.

Conclusion: The Anderson County Tax Map – A Foundation for Informed Decisions

The Anderson County Tax Map serves as a vital resource for understanding the county’s property landscape. Its comprehensive nature, user-friendly access, and practical applications make it an invaluable tool for property owners, real estate professionals, developers, and government agencies. By leveraging the information provided on the Tax Map, individuals and organizations can make informed decisions regarding property transactions, development, and other land-related matters, contributing to the continued growth and prosperity of Anderson County.

Closure

Thus, we hope this article has provided valuable insights into Navigating Property Information in Anderson County, South Carolina: A Comprehensive Guide to the Tax Map. We thank you for taking the time to read this article. See you in our next article!