Navigating Rural Development in Arkansas: A Comprehensive Guide to Loan Programs and Resources

Related Articles: Navigating Rural Development in Arkansas: A Comprehensive Guide to Loan Programs and Resources

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Rural Development in Arkansas: A Comprehensive Guide to Loan Programs and Resources. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Rural Development in Arkansas: A Comprehensive Guide to Loan Programs and Resources

Arkansas, a state known for its rolling hills, rich agricultural heritage, and vibrant communities, faces unique challenges in fostering economic growth and development. Rural areas, often characterized by limited infrastructure and a shrinking workforce, require targeted support to thrive. The United States Department of Agriculture (USDA) Rural Development program emerges as a vital resource, offering a range of financial assistance and technical support to empower rural communities in Arkansas and across the nation.

This comprehensive guide delves into the intricacies of USDA Rural Development loans in Arkansas, providing a detailed exploration of available programs, eligibility criteria, application processes, and the potential benefits they offer to individuals, businesses, and communities.

Understanding the Rural Development Landscape in Arkansas

Before delving into specific loan programs, it is crucial to grasp the context of rural development in Arkansas. The state’s rural areas, encompassing vast stretches of land and diverse communities, face several key challenges:

- Economic Diversification: Rural communities often rely heavily on agriculture, forestry, or a limited number of industries, making them vulnerable to economic downturns.

- Limited Infrastructure: Rural areas may lack access to reliable broadband internet, adequate healthcare facilities, or modern transportation systems, hindering economic growth and quality of life.

- Population Decline: Rural communities often experience outmigration, as young people seek opportunities in urban centers, leading to workforce shortages and a decline in local tax bases.

The Role of USDA Rural Development Loans

USDA Rural Development loans are designed to address these challenges by providing financial assistance and technical support to promote economic growth, improve infrastructure, and enhance the quality of life in rural areas. These loans are not merely financial instruments but rather tools for empowering rural communities to achieve their full potential.

Key USDA Rural Development Loan Programs in Arkansas

The USDA Rural Development program offers a diverse array of loan programs tailored to specific needs, including:

1. Business and Industry Loans:

- Business & Industry (B&I) Loans: These loans provide funding for new businesses, expansions, and modernization projects in rural areas, stimulating economic growth and job creation.

- Community Facilities Loans: These loans support the development of essential community infrastructure such as hospitals, schools, libraries, and water and sewer systems, enhancing quality of life and attracting new residents.

- Rural Economic Development Loans (REDLs): REDLs assist businesses in rural areas, often focusing on sectors like manufacturing, tourism, and agriculture, fostering economic diversification and job growth.

2. Housing Loans:

- Single-Family Housing Loans: These loans help low- and moderate-income individuals purchase or improve homes in rural areas, promoting homeownership and community stability.

- Multi-Family Housing Loans: These loans support the development and rehabilitation of rental housing for low- and moderate-income families, addressing the need for affordable housing in rural communities.

- Rural Housing Preservation Grants: These grants provide financial assistance to rehabilitate or preserve existing affordable housing in rural areas, ensuring safe and affordable housing for residents.

3. Infrastructure Loans:

- Water and Waste Disposal Loans: These loans fund projects to improve water and wastewater systems, ensuring safe and reliable access to essential services for rural communities.

- Electric Loans: These loans support the expansion and modernization of rural electric cooperatives, ensuring reliable and affordable electricity for residents and businesses.

- Telecommunications Loans: These loans promote the development of broadband internet infrastructure in rural areas, bridging the digital divide and enhancing access to education, healthcare, and economic opportunities.

Eligibility Criteria and Application Process

To be eligible for USDA Rural Development loans, applicants must meet specific criteria, including:

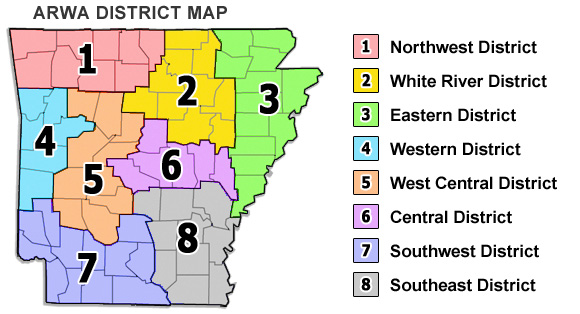

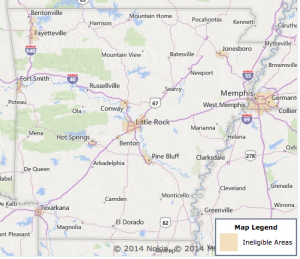

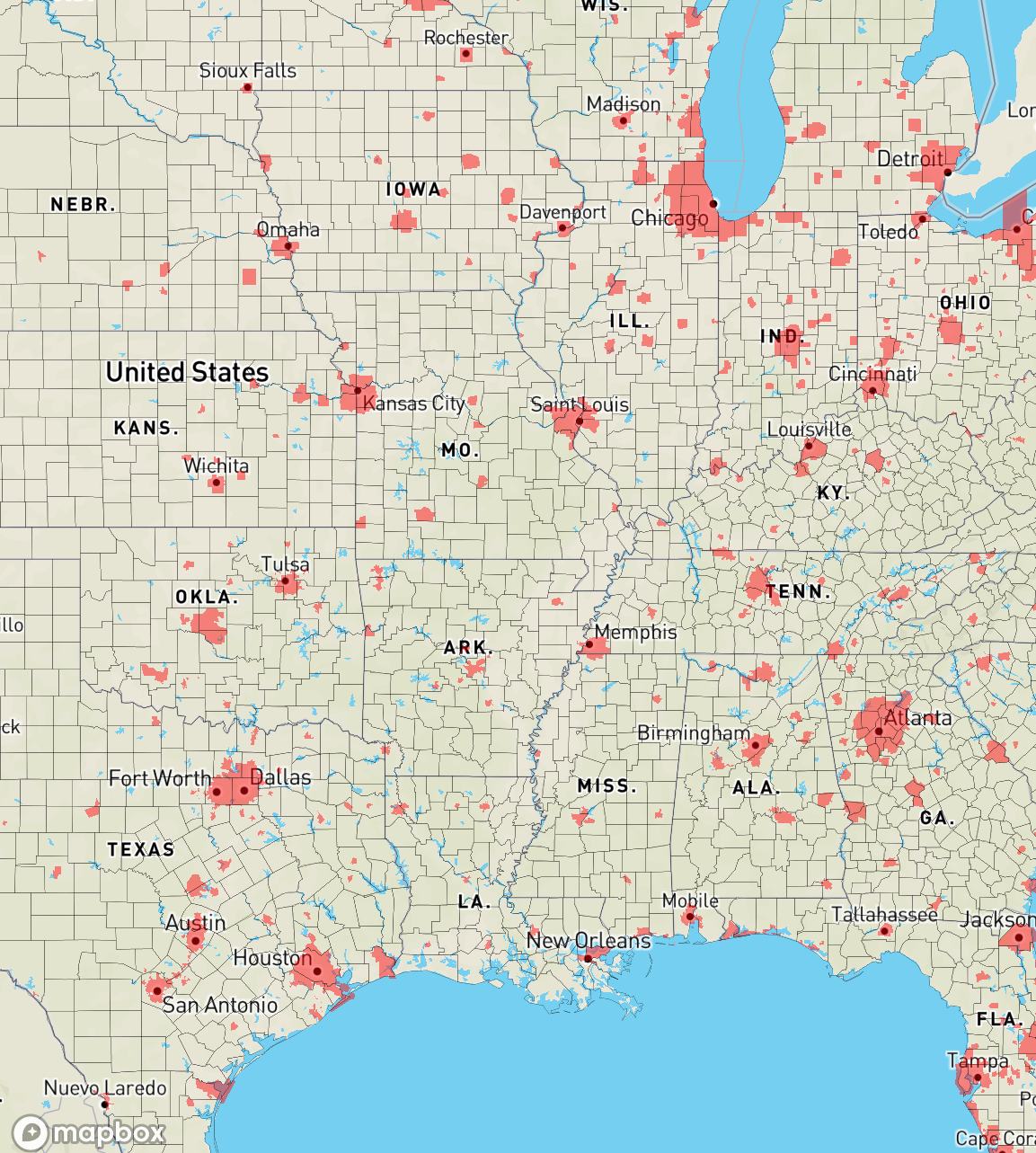

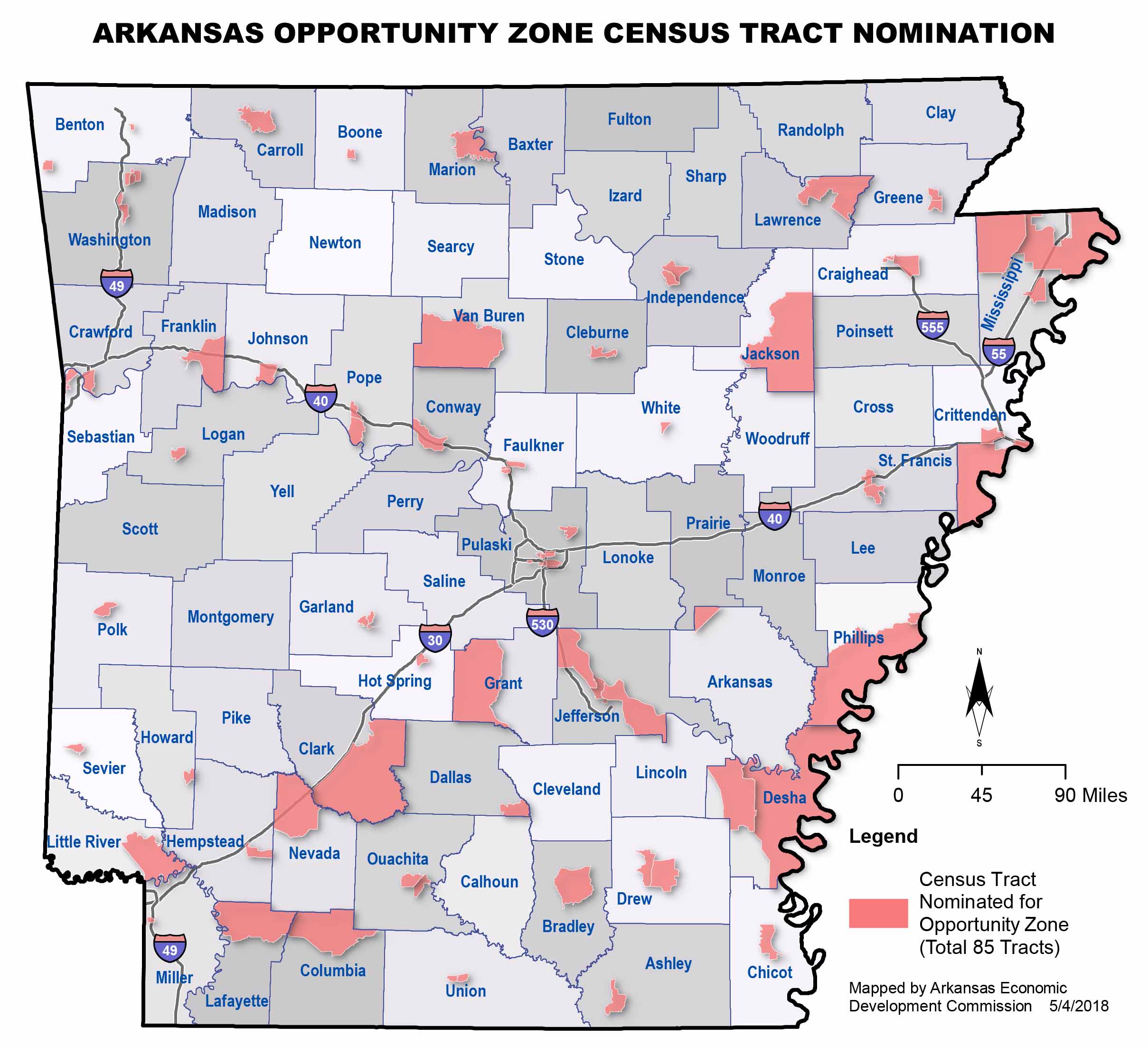

- Location: Projects must be located in eligible rural areas, which are defined by the USDA based on population density and other factors.

- Income Limits: For housing loans, income limits apply to ensure affordability for low- and moderate-income individuals and families.

- Creditworthiness: Applicants must demonstrate a satisfactory credit history and financial capacity to repay the loan.

- Project Feasibility: Projects must be economically viable and meet specific program requirements.

The application process typically involves the following steps:

- Contacting a USDA Rural Development Office: Applicants should contact their local USDA Rural Development office to discuss their project and obtain guidance on program eligibility and application procedures.

- Submitting an Application: Applications must be completed and submitted with supporting documentation, including financial statements, project plans, and environmental assessments.

- Review and Approval: Applications are reviewed by USDA staff to assess eligibility, feasibility, and environmental impact.

- Loan Closing: Once approved, the loan is closed, and funds are disbursed to the borrower.

Benefits of USDA Rural Development Loans

USDA Rural Development loans offer a range of benefits to individuals, businesses, and communities:

- Access to Affordable Financing: Loans are often offered at competitive interest rates and terms, making them an attractive option for rural borrowers.

- Economic Growth and Job Creation: Loans stimulate investment and business development, creating new jobs and boosting the local economy.

- Improved Infrastructure: Loans support the development and modernization of essential infrastructure, enhancing quality of life and attracting new residents.

- Community Revitalization: Loans help revitalize rural communities, improving housing, healthcare, education, and other vital services.

- Environmental Sustainability: Some programs prioritize projects that promote environmental sustainability, such as renewable energy and water conservation.

FAQs on USDA Rural Development Loans in Arkansas

Q: What are the eligibility requirements for USDA Rural Development loans in Arkansas?

A: Eligibility requirements vary depending on the specific loan program. Generally, applicants must be located in eligible rural areas, meet income limits (for housing loans), demonstrate creditworthiness, and have a feasible project.

Q: How do I find out if my area is eligible for USDA Rural Development loans?

A: You can use the USDA Rural Development website or contact your local USDA Rural Development office to determine if your area is eligible.

Q: What are the interest rates and loan terms for USDA Rural Development loans?

A: Interest rates and loan terms vary depending on the specific loan program and the borrower’s creditworthiness. Contact your local USDA Rural Development office for detailed information.

Q: How do I apply for a USDA Rural Development loan?

A: Contact your local USDA Rural Development office to discuss your project and obtain guidance on the application process. You will need to submit a completed application with supporting documentation.

Q: What are the benefits of using a USDA Rural Development loan?

A: USDA Rural Development loans offer affordable financing, support economic growth, improve infrastructure, promote community revitalization, and encourage environmental sustainability.

Tips for Applying for USDA Rural Development Loans

- Plan Thoroughly: Develop a detailed business plan or project proposal outlining your goals, financing needs, and expected outcomes.

- Seek Professional Assistance: Consult with a financial advisor or loan officer to ensure you meet eligibility requirements and understand the application process.

- Gather Necessary Documentation: Prepare all required documents, including financial statements, project plans, and environmental assessments.

- Contact Your Local USDA Rural Development Office: Reach out to your local office for guidance and support throughout the application process.

- Be Patient: The application process can take time, so be prepared for delays and maintain communication with USDA staff.

Conclusion

USDA Rural Development loans play a critical role in fostering economic growth, improving infrastructure, and enhancing the quality of life in rural communities across Arkansas. By providing access to affordable financing and technical support, these loans empower individuals, businesses, and communities to achieve their full potential. By understanding the program’s intricacies, eligibility criteria, and application processes, rural residents and businesses can leverage these resources to create jobs, improve infrastructure, and build a brighter future for Arkansas’s rural communities.

Closure

Thus, we hope this article has provided valuable insights into Navigating Rural Development in Arkansas: A Comprehensive Guide to Loan Programs and Resources. We thank you for taking the time to read this article. See you in our next article!